- Blog

- Jan 05, 2021

- By Cam Sivesind

Owners of networks – franchises, directories, aggregators, and marketplaces – have a problem: they aren’t getting credit for the value of the advertising they provide to partners.

“Houston, we’ve had a problem.” It’s an oft-used phrase when things aren’t going right. But while you may not be experiencing an oxygen leak in outer space, the problems you face could be just as jeopardizing for your business and, worse, the perception of your business’ effectiveness.

If you are a network owner operating an online marketplace or franchise operation, you already know how difficult it is to quantify the full value of your marketing efforts to trusted sellers – your partners.

You are missing out on the credit where credit is due for directing high-quality traffic to your selling partners and for promoting them in various ways through your network. You are likely influencing many conversions, but are sellers giving you proper credit for that value?

How the Marketing Ecosystem Works

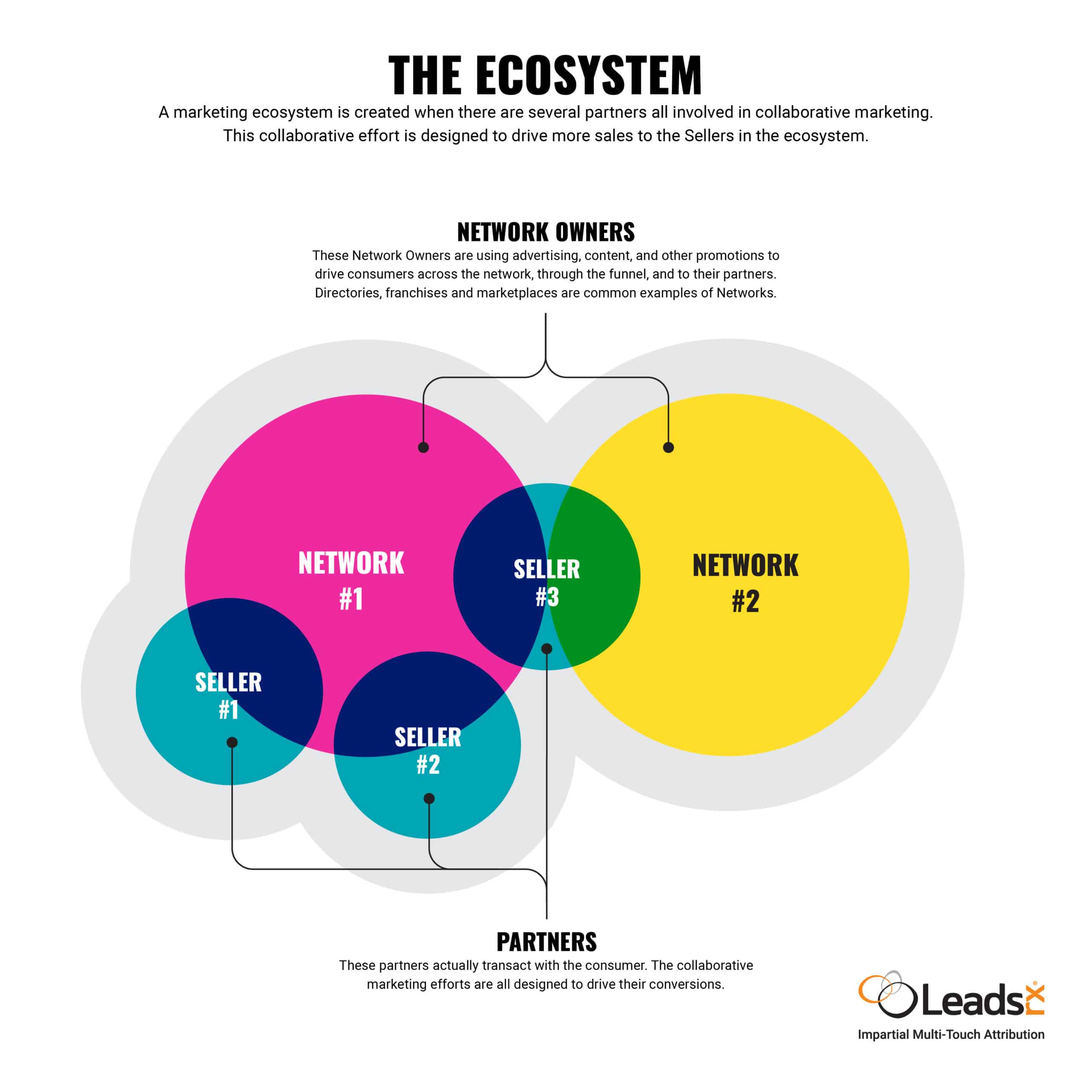

First off, let’s define network owners, partner sellers, and how this whole ecosystem functions.

A network owner manages a marketplace, aggregation site, directory, or franchise operation that is composed of several partners selling similar products and/or services. The job of the network owner is to offer promotional opportunities to partner sellers and to attract consumers to the network. As consumers become qualified, they are passed into the sales funnels of appropriate partners.

Those partners help these in-market consumers move through the sales funnel and, most importantly, are responsible for making the final sale. What makes this approach really interesting is that one seller might in fact be participating in multiple networks, each independently owned and operated. In this ecosystem of trusted partners, complexity is the norm, and trust and transparency are essential.

A Prime Example: Automobile Marketing

Think of an auto dealership that advertises on cars.com, cargurus.com, and autotrader.com. All three of these networks individually manage their own marketplace composed of partners selling cars. Each partner may belong to multiple networks, creating a crossover of participation and complexity. Bring all the networks together and you have a marketing ecosystem that is collectively marketing in an effort to create conversions (sales of vehicles).

Now let’s look at a typical customer journey:

- A consumer finds the car of their dreams on cars.com (the network) and is exposed to a banner ad for a dealership, a vehicle detail page, and then clicks through to the local dealer’s website (the partner). That same consumer continues their search for a car over the coming weeks and clicks on Google Ads, visits Kelly Blue Book – another network, actually – to get an estimate for their trade-in, and maybe even sees a TV commercial for the car dealer.

- Eventually, the consumer makes a purchase from the car dealer’s showroom. From the dealer’s perspective, all of their network partners are working on its behalf to sell cars. The networks and partner sellers operate in lockstep as a cooperative and cohesive unit.

What makes this model difficult from an analytics and valuation standpoint is all of the moving pieces and cross-marketing, or perhaps non-cooperative marketing, that is occurring. You have the auto aggregate site (network) that is promoting, marketing, and advertising on one end. The dealership (partner) is on the other end, also promoting, marketing, and advertising – but the dealership is also selling.

The entire ecosystem of networks and their partners is contributing to the buyer journey. This results in a fragmented and typically non-unified journey. And, while only one of the partners (a dealer) typically collects the revenue from the sale, that partner lacks insight into the entire buyer journey, which is distributed across multiple network owner websites (cars.com, cargurus.com, autotrader.com).

Everyone in the ecosystem is working together but also competitively – the car aggregate sites work hard to promote the inventory of each partner dealership, but they likely have multiple partners selling the same or similar vehicles, each vying for the consumer’s dollar.

Likewise, multiple car aggregate sites are promoting the very same partner dealership, each vying for the dealer’s ad budget. This creates a flurry of energy and activity that is typically very difficult to understand analytically.

No one in the ecosystem has true visibility into the networks that are performing best or to the dealership partners selling the most cars. Few networks will get the credit they deserve in this process if the selling partner at the end does not know which network directed a buyer their way.

If you are a network owner, this is a huge problem.

Identifying a Non-Linear Customer Journey

Let’s break down another customer journey example, this time using car insurance:

- A consumer in need of auto insurance saw a banner ad featuring Flo, the lovable pitch lady for Progressive insurance. They clicked on the ad and were taken to the Progressive – the network owner – website where they researched car insurance policy options and corresponding costs. The consumer decided not to purchase insurance at that time but a couple of days later did more research on Google and came across Progressive again as an option.

- The consumer gets distracted and pauses their research once again, but later that day types “Progressive” directly into a Google search and clicks over to the insurer’s site. The consumer then sees there is a local Progressive agent a couple of miles away and picks up the phone and calls for final reassurance before signing up for a new policy.

How does Progressive prove its involvement in the eventual sale of that policy? It’s clear its banner ad created awareness and Progressive’s paid and organic search helped drive the consumer to the local agent. It’s a complicated, distributed journey.

From the local agent’s view, the consumer appears to have come from a simple Google search. But in reality, the initial discovery of Progressive came from banner ad. Local agents pay an advertising fee to Progressive, their company was listed, and Progressive became an influential touchpoint for the consumer.

So now – if you are indeed in charge of partner recruitment for a network or are selling network advertising services – you are probably thinking to yourself, “wait a minute, we are missing out and, ‘Houston, we do have a problem.’”

Plunging into the Pain Points

Let’s delve a bit more into the pain that is caused when the marketing contribution made by network owners is unclear to seller partners. The last thing a network wants is its partners guessing or using their own instinct/bias in assessing the effectiveness of the network. But it’s happening, continually.

Not knowing the winding paths of customer journeys leads to the erosion of trust. The network owner has to say anecdotally, “Our marketing is working on your behalf.”

Yet the partner is left to ask, “How do we know for sure your marketing is working?”

Partners want robust performance measurement. They certainly don’t want performance being self-declared by the network. Taking too much credit for the lead generation could make the network’s declared results suspect to their seller partner. The current landscape is ripe with a lack of agreement between parties within the network, causing fear, uncertainty, and doubt.

Sellers are wondering if the network owner is pulling one over on them; conversely, network owners are unable to prove to partners their true worth and value. It’s a conundrum wrapped in a puzzle inside a Pandora’s box.

Examples of the Complexity of Network/Partner Relationships

The auto and auto insurance network examples have their share of stress and uncertainty, but they show how complex network/partner relationships can be. Both ends of the network want transparency and trust in their partnership. Here are a few scenarios where the two sides of the partnership could end up at odds:

- Broken or Incomplete Journeys: Buyer journeys are often complex and long. With potentially multiple networks performing marketing on behalf of multiple partners, no one is seeing an impartial unified view of the actual buyer journey. Often, network touchpoints are overlooked or missed completely or are under-reported in non-optimal ways like .csv files, leading to inaccurate journey mapping. With this inaccuracy, buyer behavior is impossible to understand or model. How can networks accurately and impartially “show their homework?”

- Loss of Competitive Share: Because there are often multiple networks each representing the same partners, network owners must compete for their share of ad dollars from those selling partners. Without the ability to demonstrate defensible value, a network will suffer as partners take their dollars elsewhere. Often this means other networks will win the budget, but partners will also explore completely different channels that can in fact be measured – like Google, Facebook, and other ad technologies.

- Inaccurate ROAS: Return on ad spend (ROAS) is a key metric, but it can be underwhelming in the network owner-seller partnership. Because there is questionable data from networks with buyer journeys missing or altogether having inaccurate data, the cost of network promotional advertising can’t be properly allocated to new customer acquisition. Budget spent with networks ends up appearing as an inflated “expense” rather than the investment that it is. Revenue can’t be attributed back to the network, resulting in underwhelming (or negative) ROAS. Without reliable, defensible ROAS calculations, ad spend cannot be optimized – leading to higher costs, wasted ad spend, and ineffective programs.

A real estate aggregation site might show a 1.5X ROAS because only a few home buyers (sales) are being credited back to that network’s touchpoints. In reality, there could be hundreds more buyers that should be credited to the network, and this could result in the true ROAS being more like 3X or 4X. That’s a huge difference, and the inaccurate or missing data is certainly not doing the network any favors; nor is the partner selling agent getting information that would be helpful. Knowing that ad dollars being spent with the network are indeed effective is valuable information, and it indicates to the seller-agent they might want to allocate more of their ad budget to the network that is pushing more business their way.

- An Attribution Problem: “Ecosystem Attribution” is impossible to quantify within the systems used by seller partners. No matter which marketing analytics package a seller uses to determine its digital advertising effectiveness, many network touchpoints contributing to the customer journey will not appear. This is because most tools do not work across web domains, and networks have no ability to trigger touchpoints in their partner’s systems. The solution for this has been for network owners to provide data extracts that sellers can then upload into various analytics packages. But this process is laborious and error prone.

What are the Consequences?

Despite the fact that networks do a good chunk of marketing and promotion, often other advertising channels – Google Ads, Facebook, even organic search – receive the credit for a conversion. Ultimately, the selling partner’s tracking software should be the system of record that captures accurate touchpoints and conversions so that ROAS calculations can be trusted and acted upon. Without this approach, networks are faced with declaring their own value while watching their ad dollars erode to more trusted channels and competitors.

Many sellers will admit that they joined a network because the network does an incremental job of marketing. Networks often appear neutral to consumers and therefore have a degree of influence for many shoppers – something that is difficult to get from Google, Facebook, and other ad platforms. Partners anecdotally know the worth of the network; but inaccurate or missing data makes it hard for networks to “prove their return on investment” and build that added trust with their seller partners.

What’s the Solution?

Essentially, all networks are affected by this lack-of-credit problem. These include aggregation sites, franchisors, national and regional auto dealers, rental and home sales companies, directory sites – any network that doesn’t sell products or services directly, but rather markets on behalf of partners at the other end of the network.

If you are a network, it’s probably very apparent by now that there is a problem. Here are some ways to address this issue:

- Networks need to be able to share data with their seller partners.

- Networks should be creating marketing materials to facilitate their sales teams’ communication of this problem.

- Networks should shift their focus from “impressions and clicks” to “leads and sales” – that is what their partners want anyway.

LeadsRx Ecosystem Attribution™ is designed to solve this problem. It unifies the journeys across networks and to their seller partners – so networks have impartial and accurate views of the value they bring to partners.

If you are in marketing or sales for a network site, schedule a personalized demonstration of how our Ecosystem Attribution solution would work in your use case.